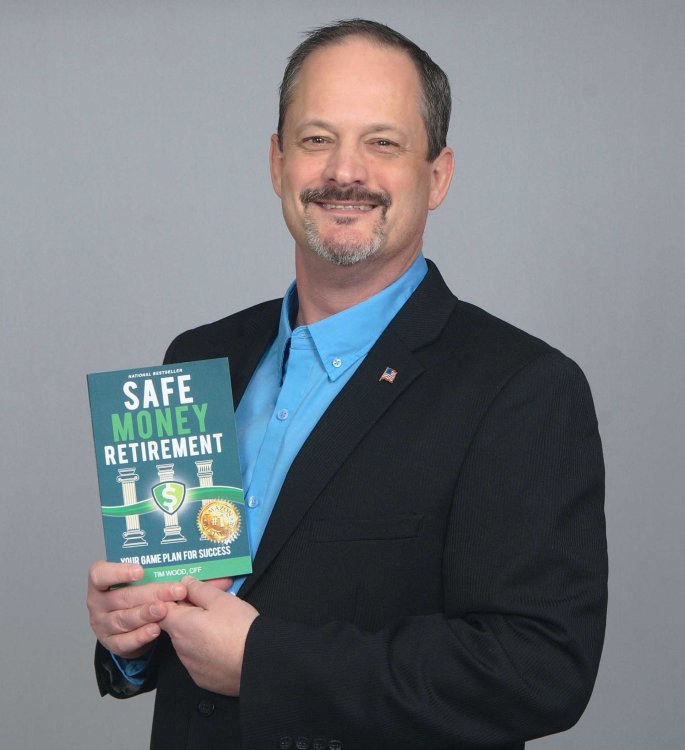

Tim Wood, Certified Financial Fiduciary®

Safe Money Retirement®

Certified Financial Fiduciary®

Ed Slott Elite IRA Advisor℠

Guaranteed Lifetime Income Plans

Retirement Tax Planning

Plans with Market-Like Gains & NO Market Losses

Asset Protection Planning

Life, Medicare, and LTC Planning

More information about Tim can be found in the About Us Tab above

Our Most Recent Article

Prioritizing Income in Retirement

September 21, 2023

The Key to Lifelong Happiness Retirement marks a significant life change going from the accumulation phase to the distribution phase and is often accompanied by dreams of leisure, travel, and relaxation. While many individuals diligently accumulate assets throughout their working ...

Read more >

Tim Wood, Certified Financial Fiduciary®

Safe Money Retirement®

1303 Sunset Dr

Suite #3

Johnson City, Tennessee 37604

tim@safemoneyretirement.com

(833) 413-7233

Looking For Answers?

Download our Safe Money Guide and learn more about safe retirement options that can help you achieve your retirement goals safely - FREE!

Fixed Annuities: Unlocking Growth with Zero Losses

(July 7, 2023

When it comes to financial planning and securing a stable ...

Maximize Your Retirement Savings with These Tips

(February 23, 2023

Many Americans don't feel like their retirement savings are on ...

Wealth in Retirement is Not About How Much Money You Have Saved

(August 23, 2022

Probably the biggest fallacy in retirement planning (and one being ...

The Reallocation Factor

(June 22, 2022

Diversify. Don’t lock yourself into one strategy during a period ...

How Much “Safe Money” Should Be In Your Portfolio?

(February 5, 2022

Many retirees understand they should be protecting a portion of ...

Get To The Point-To-Point

(September 10, 2021

These days, many retirees are very concerned about market volatility ...

Fixed Annuities: Unlocking Growth with Zero Losses

(July 7, 2023

When it comes to financial planning and securing a stable ...

Maximize Your Retirement Savings with These Tips

(February 23, 2023

Many Americans don't feel like their retirement savings are on ...

Wealth in Retirement is Not About How Much Money You Have Saved

(August 23, 2022

Probably the biggest fallacy in retirement planning (and one being ...

The Reallocation Factor

June 22, 2022

Diversify. Don’t lock yourself into one strategy during a period ...

How Much “Safe Money” Should Be In Your Portfolio?

February 5, 2022

Many retirees understand they should be protecting a portion of ...

Get To The Point-To-Point

September 10, 2021

These days, many retirees are very concerned about market volatility ...